Workers’ Comp Hub Newsletter: Spring/Summer 2016

This month we report on the latest in the growing national conversation on workers’ comp and discuss the potential for national action. We also bring you news on a medical scam in California that has hurt thousands of workers and cost the system over a billion dollars, as well as a review of how injured workers and their attorneys are challenging the constitutionality of Florida’s workers’ comp system.

– Jim Ellenberger

Conversation grows on national workers’ comp reforms

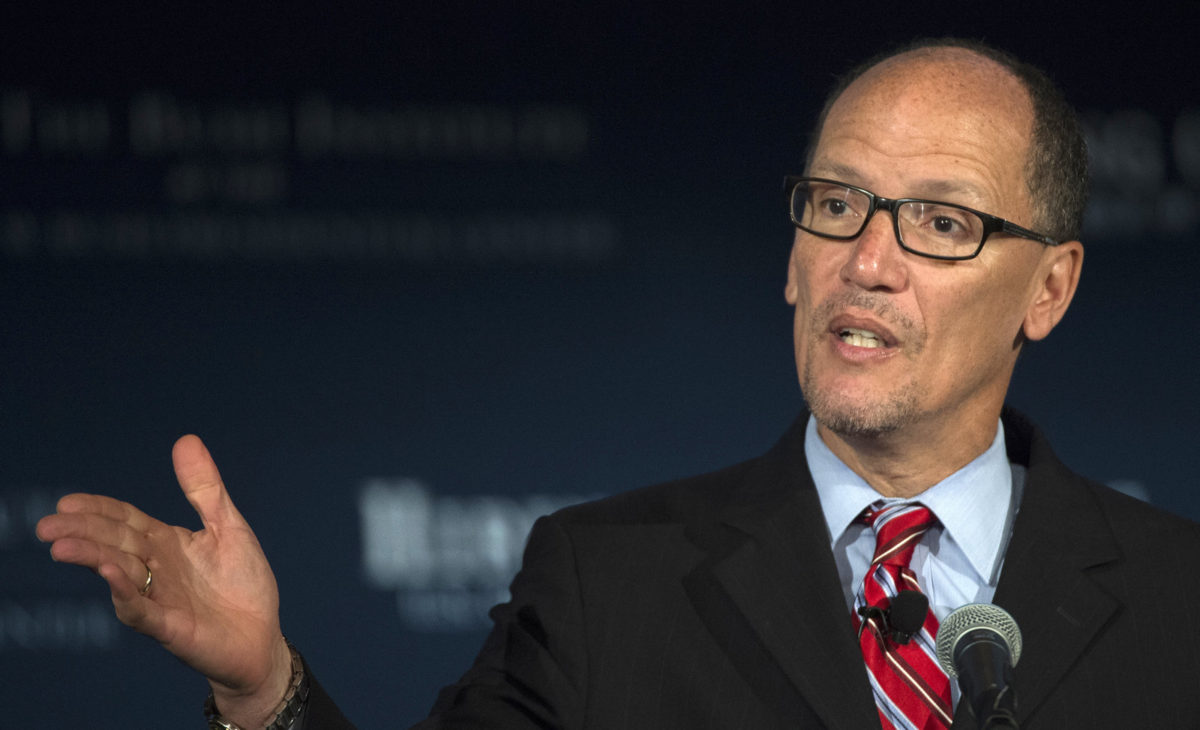

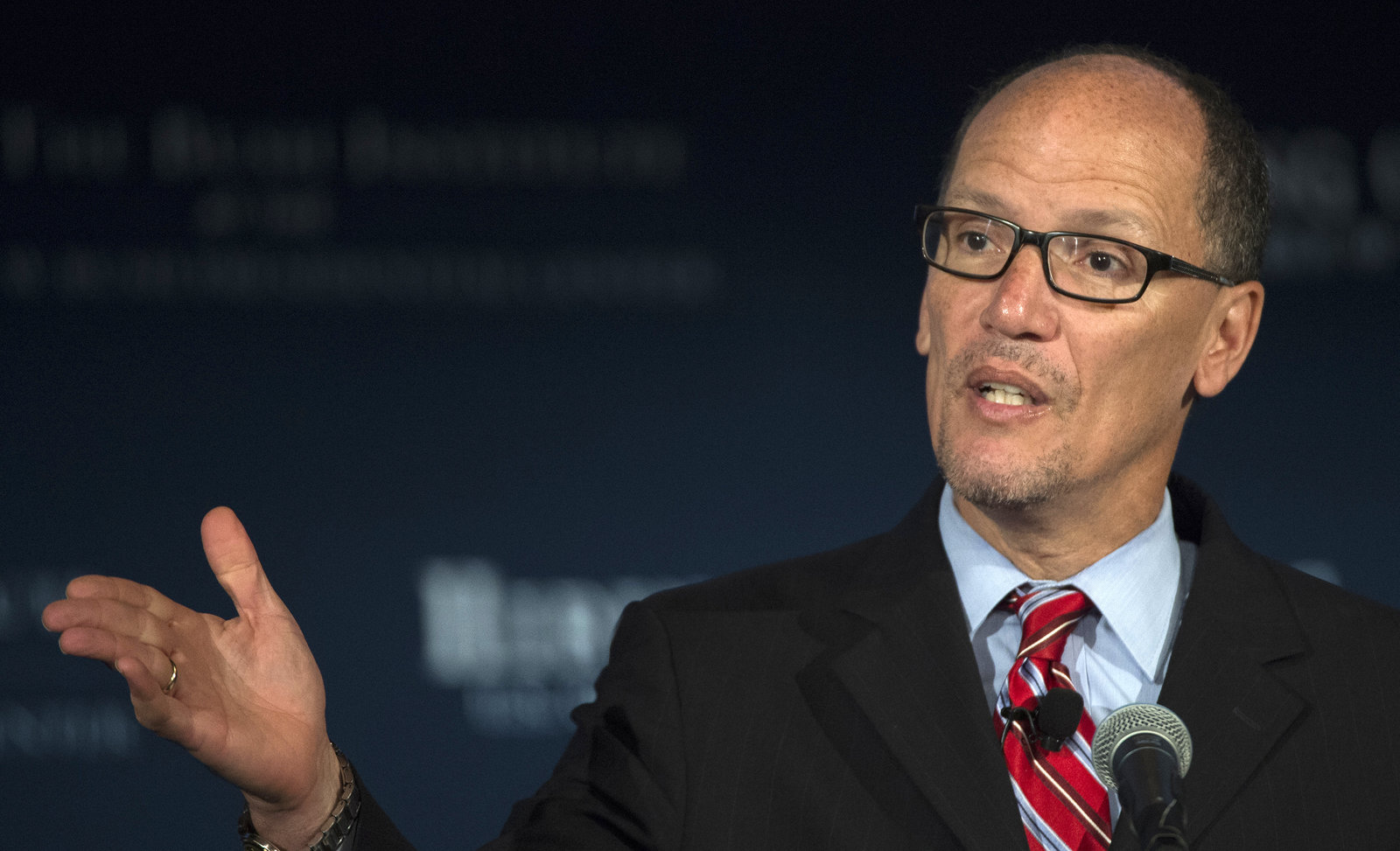

Last fall, ten senior Democrats penned a letter to Labor Secretary Thomas Perez calling for expansion of federal authority and oversight over workers’ comp. Since then, the Department of Labor has commissioned a report “to document the precise nature of this problem across the country,” and has begun investigating the firm PartnerSource, one of the top providers of opt-out services in Oklahoma and Texas.

While inadequacy of benefits, violations of due process and a host of other issues are raising concerns, the recent trend toward employer opt-outs from state workers’ comp systems has been especially alarming. “What opt-out programs are really all about is enabling employers to reduce benefits,” Secretary Perez told NPR, adding that employer-designed plans create “a pathway to poverty for people injured on the job.” He expressed particular concern over mandatory arbitration clauses, which force injured workers to appeal denied claims through a private arbitrator, often partial to the employer, and “usually work to the detriment of injured workers.”

Reacting to the possibility of federal action, the insurance industry has scrambled to organize its own national conversation on workers’ comp. In May, industry leaders met for a summit to discuss perceptions of “how comp is succeeding and where it may have shortcomings.” Moderator Robert Wilson emphasized the need to shift industry focus from management and cost-efficiency to ‘recovery’ and ‘return to work’. This new rhetoric targets one of the main issues that has caught national attention, the overburdening of Social Security Disability Insurance and other federal programs by injured workers whose needs are not met in the workers’ comp system. Antagonistic to federal involvement, Wilson argues that industry insiders are the most qualified leaders in the conversation on national workers’ comp reform. Yet despite Wilson’s and the industry’s bravado, it is clear that many of the usual deeply misleading claims about injured workers remain at the heart of their discussion. The industry’s discrediting of workers’ voices is underlined by the fact that the conference, purported to include “all stakeholders,” in fact included a token number of worker advocates and involved no injured workers.

The federal government has not taken an active interest in workers’ comp since 1972, when a National Commission on Workmens’ Compensation Laws concluded that workers’ comp systems on the whole provided “inadequate and inequitable” protections for injured workers. Fearful of federal regulation, most states passed laws to increase workers’ comp benefits, but many of the Commission’s recommendations remained disregarded and minimum standards were never implemented.

In 2004, budget cuts put an end to the last remnants of federal oversight, a program that tracked state workers’ comp changes and their compliance with the Commission’s recommended standards. John Burton, a national expert on workers’ comp and Chairman of the 1972 Commission, has written that “the primary obstacle to state reform was competition among states for employers and the fear that an adequate workers’ compensation program in a state would drive employers to a less expensive jurisdiction.” Over the past two decades, despite a dramatic decline in workers’ comp insurance rates, this argument has been used to push a slew of workers’ comp deforms in every state, leaving workers in an increasingly precarious situation.

While the Labor Department’s investigation is an important step in counteracting opt-out laws, the agency has limited power under the Employee Retirement Income Security Act (ERISA), and can only force employers to abide by the terms of their own plans. ERISA gives the Department little authority over the design of opt-out plans, which can legally offer lower benefits than the state system or exclude certain occupational illnesses. Furthermore, it’s unclear how effective ERISA protections could be in the long-term. Like many workplace regulations, its enforcement relies largely on employees who file complaints. But for workers trapped in employer-designed opt-out programs, this is rarely a viable option: challenging a workers’ comp decision under ERISA brings high risks, including employer retaliation and the burden of paying all legal fees if the claim is denied. If a claim is successful, the reward is meager, only awarding benefits owed under the employer’s own plan.

“We can conceive of no rational basis,” wrote the Oklahoma Workers’ Compensation Commission, to create a “subclass of injured workers,” who are subject to benefit plans in which the employer “can determine when it will be liable and when it will not be liable.”

Given the decimation of workers’ comp protections across states, it is clear that greater federal authority is necessary to safeguard injured workers’ human rights. One potential avenue for federal action is through the Commerce Clause of the Constitution, which gives Congress the authority to regulate activities that “substantially affect” interstate commerce. This Clause applies to even tenuously commercial activities if their cumulative effects are significant, and the drive to attract employers across state lines clearly substantially affects commerce. In the case of workers’ comp, Congress has a compelling incentive to set regulatory standards because, as recent evidence shows, the failures of state workers’ comp systems directly affect federally-funded programs by forcing injured workers into Disability and Medicaid when they are unable to access wage replacement and medical coverage.

National minimum standards for workers’ comp would be a big step towards restoring workers’ comp protections, but some argue that a larger overhaul is necessary. A national workers’ comp program would standardize benefits across the country and halt the “race to the bottom” caused by states’ desire to attract employers. Still, certain structural elements of the workers’ comp system fail to meet workers’ needs or exclude some workers altogether. By tying benefits to traditional employment, for example, the system leaves an increasingly large number of contract workers unprotected. And by setting up an adversarial system in which workers have to prove the work-relatedness of their claims, workers’ comp places injured workers at risk for harmful delays that affect their health and livelihoods. To address these concerns, some activists are calling for a universal, publicly financed healthcare system that would integrate workers’ comp medical coverage. With universal healthcare covering all healthcare needs, work-related and otherwise, injured workers’ income needs could still be met by the comp system or through an integrated social insurance system combining workers’ comp, SSDI and other social supports.

The devastation of workers’ comp and injured and ill workers’ lives is making it increasingly clear that transforming workers’ comp must be a national project, but given the insurance industry’s maneuvering and political gridlock in Washington, there is no certainty that changes will bring about better outcomes for workers. The time is ripe for activists to push the conversation on workers’ comp reform, bringing injured workers’ voices,experiences into the center of the discussion.

Florida Supreme Court rules for injured workers

As state legislatures continue to cut essential benefits and protections in the workers’ comp system, injured workers and their advocates have increasingly turned to the judiciary system—as with New Mexico farmworkers’ recent victory—to challenge unjust laws.

In two separate decisions this April, the Florida Supreme Court and First Court of Appeals ruled unconstitutional a workers’ comp statute that limits the amount injured workers can pay an attorney to represent them in a workers’ comp claim. By placing unreasonably low limits on attorney fees, the law has made it impossible for many injured workers to find legal representation to contest a denied claim. The Court’s decision stated that the law was unconstitutional because it violates injured workers’ “rights to free speech and to seek redress of grievances.” By allowing insurance companies to deny valid claims with impunity, the law also encouraged fraudulence and cost shifting.

“Without the likelihood of an adequate attorney’s fee award, there is little disincentive for a carrier to deny benefits,” wrote Justice Barbara Pariente in the Supreme Court’s majority decision, adding that “without the right to an attorney with a reasonable fee, the workers compensation law can no longer ‘assure the quick and efficient delivery of disability and medical benefits to an injured worker.’”

Unfortunately, the Florida Supreme Court recently declined to hear two other important workers’ comp cases that challenged the constitutionality of exclusive remedy on the grounds that the system’s eroded benefits no longer provide a reasonable alternative to suing an employer. The Court is still considering the case Westphal v. City of St. Petersburg, which addresses a workers’ comp statute that creates a gap in benefits for workers who are totally disabled by an occupational injury but have not reached maximum medical improvement by the time their temporary disability benefits expire. In the wake of these challenges, Florida leaders have said workers’ comp will be a priority in the 2017 legislative season.

Profiteers exploit injured California workers and defraud honest employers and the public out of $1 billion

A new study by the Center for Investigative Reporting shines a spotlight on the rampant fraud in California’s workers’ comp medical system. Medical professionals across the state have created and participated in kickback schemes that endanger injured workers, robbing the system of more than a billion dollars. Taking advantage of loose oversight in the workers’ comp system, scammers prey on injured workers by performing expensive, often unneeded, surgeries and prescribing unregulated medications, then bill insurance companies for these “treatments” through the lien system.

Originally designed to protect injured workers, the lien system is supposed to ensure timely medical care for workers whose claims have been denied or delayed. Medical providers can give immediate treatment, then file a claim to recover the cost from the insurance company. Yet profiteers have exploited the system’s regulatory holes and lack of transparency, placing injured workers at risk with unnecessary and even harmful treatment plans so they can reap bigger profits from their claims. A network of bribes encompasses workers’ comp attorneys, doctors, billing experts, and pharmaceutical sales reps, all of whom direct vulnerable injured workers towards fraudulent medical providers.

Prosecutors have brought cases against over 80 people for medical scams in the California workers’ comp system, but injured workers harmed by the fraud have so far had little recourse to justice. Moreover, widespread fraud has raised costs in a system that already places workers at odds with insurers and employers, fueling a “race to the bottom” in which state legislatures cut important workers’ comp benefits to appease big business. The medical fraud in California should serve as a wake-up call for legislators across the country to strengthen regulatory oversight, increase transparency, and ensure the workers’ comp system protects injured workers’ human rights.

Workers’ Memorial Day

Each year, Workers’ Memorial Day marks a moment of mourning for workers who have died on the job. It has also become a time to call attention to the causes of workplace fatality and fight for safer, healthier jobs. Worker deaths from traumatic incident rose to 4,821 in 2014, the last year for which data is available, and new research shows that annual deaths from occupational illness are much higher than previously estimated: 95,000 in one year. Tragically, most of these deaths are entirely preventable by compliance with basic health and safety regulations.

A report released by the National Coalition for Occupational Safety and Health (COSH) in April shows how irresponsible business decisions lead to increases in workplace deaths and emphasizes that contract workers are among those most at risk. The Center for Progressive Reform (CPR) has created a manual that further explains why employers are rarely held accountable for harming workers and guides workers’ rights advocates on the steps necessary to connect with prosecutors, law enforcement, and regulators about investigating workplace incidents as potential crimes. Co-author Ron Wright, a Criminal Law Professor and CPR Member Scholar, stresses that pursuing criminal charges “deters employer neglect by sending the message that ignoring workplace health and safety won’t be tolerated. Not only does prosecution lay blame where it belongs, it provides a powerful disincentive to reckless behavior.”

Take Action

Attend an academic symposium on the future of workers’ comp

The Pound Institute and Rutgers will host a one-day symposium in Camden, NJ, on September 23 to explore the deterioration of the Grand Bargain and what can be done to protect workers’ rights. Register.

Reports

New Mexico rules exclusion of farmworkers from workers’ comp unconstitutional

The Supreme Court’s decision in the case, brought by the New Mexico Center on Law and Poverty, definitively ends this “arbitrary discrimination” against farm and ranch workers.

Gig economy workers should get workers’ comp

In a new report and an accompanying article, the National Economic Law Project (NELP) spotlights workers in the on-demand economy, who are frequently denied workers’ comp coverage by their employers. The San Francisco Chronicle also reported on Uber’s denial of coverage to its employees.

Amicus brief and update from Okla. opt-out case

NELP filed an amicus brief in Dillards v. Vasquez, the Oklahoma Supreme Court case challenging the constitutionality of the state’s opt-out provision. ProPublica and NPR report the case has stalled the corporate campaign to expand opt-outs to more states.

Profiteers’ exploitation of injured workers

Reveal’s four–part investigative report and podcast mine data from more than a million Calif. court cases and secret recordings of industry insiders, revealing shocking profiteering off of workers and honest employers.

Chemical breakdown

The Houston Chronicle’s four-part series investigates why regulation is failing to keep workers and the public safe from toxic chemicals.

Attack on workers’ comp in Illinois

An article from In These Times discusses how the nationwide attacks on workers’ comp are playing out in Illinois.

Deterring health and safety violations

The Center for Progressive Reform published a report exploring why OSHA’s penalties fail to deter employers from dangerous workplace practices, and what can be done.