Illinois Wage Lien Act fact sheets

A coalition of Chicago worker centers introduced a bill today that would create a new tool to enable workers to successfully recover stolen wages from their employers.

Employers that commit wage theft know that they are unlikely to face any real consequences. Fewer than one in four workers in Illinois recoup stolen wages within a year. Even when workers win their cases, they may not get the money they are owed. Only one in ten cases sent to collections results in a successful recovery.

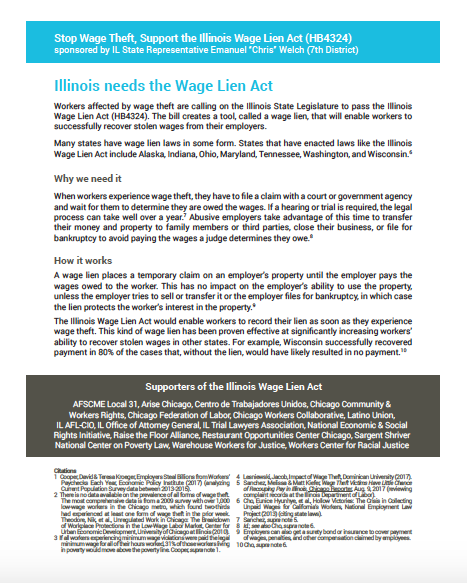

The Illinois Wage Lien Act (HB4324) is a critical missing piece in Illinois’ workplace enforcement system. When workers experience wage theft, they have to file a claim with a court or government agency and wait for them to determine they are owed the wages. If a hearing or trial is required, the legal process can take well over a year. Abusive employers take advantage of this time to transfer their money and property to family members or third parties, close their business, or file for bankruptcy to avoid paying the wages a judge determines they owe.

The tool created by the bill, a wage lien, would place a temporary claim on an employer’s property until the employer pays the wages owed to the worker. This has no impact on the employer’s ability to use the property, unless the employer tries to sell or transfer it or the employer files for bankruptcy, in which case the lien protects the worker’s interest in the property.

The Wage Protection Act Coalition includes Centro de Trabajadores Unidos, Chicago Community & Workers’ Rights, Latino Union of Chicago, Restaurant Opportunities Center of Chicago, and Raise the Floor Alliance

Check out the fact sheets on the new bill that we created with Raise the Floor.

Additional Resources

IL Wage Lien Fact Sheet NESRI Feb2018_FINAL

IL Wage Lien Fact Sheet NESRI Feb2018_FINAL

IL Wage Lien Comp Chart NESRI Feb2018

IL Wage Lien Comp Chart NESRI Feb2018